[Major disclosure: everything you are about to read is extremely specific to the purchase of my home. There are an infinite number of variables in every real estate transaction, however, I hope to shed some light on purchases similar to mine.]

So, what exactly are closing costs?

Well, that’s a mouthful.

As I mentioned above, every situation is different: interest rates will vary, your title company may have their own set of fees, your time line will greatly influence where dollars are allocated, and your attorney may charge differently. Among several other things.

So, let’s get rid of the vague, half-ass answers your lender gave you and really expose the truth behind the allusive “closing costs.”

I want you to be able to see a real-life example of what to anticipate before you head to the closing table.

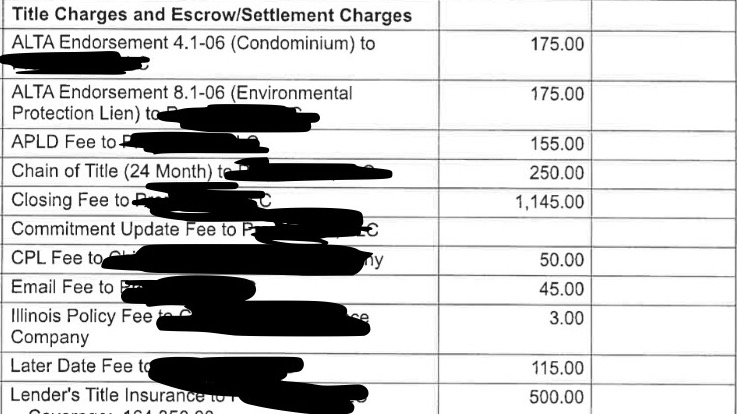

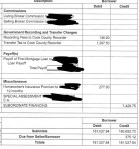

Below you can see the list of my personal closing costs, based on the purchase price of $173,000. Today, I’m focusing on the “debit” column, although you may see a lot of interesting information in the “credit” column, which is admittedly a more exciting column for the buyer. I will address the credit column in another post.

I’ve also included some messy looking photos of the same information (you know, for certifiable proof). I did smudge out the names of the title company, lawyers, real estate firm, and any insurance companies as to not create any bias after reading.

DEBIT

Lender Fees: $1050

Application Fees: $150

Assessments: $113.48

Prepaid Interest $19.14 per day for 15 days: $306.19

Homeowner’s Insurance for 4 months at $23.08: $92.32

Property taxes for 7 months at $199.55: $1396.85

ALTA endorsement 4.1-06 (condominium): $175

ALTA endorsement 8.1-06 (Environmental Protection Lien) $175

APLD Fee: $155

Chain of Title (24 month): $155

Closing Fee: $1145

Commitment Update Fee: $0

CPL Fee: $50

Email Fee: $45

Illinois Policy Fee: $3

Later Date Fee: $115

Lender’s Title Insurance

(Coverage: $164,350

Premium: $500): $500

Package Delivery Fee: $45

Wire Transfer Fee: $40

Buyer’s Attorney Fee: $650

Recording Fees to Cook County: $146.50

Transfer Tax to Cook County: $1297.50

Homeowner’s Insurance Premium: $277

GRAND TOTAL

*drumroll, please*

Total: $8,082

Certainly not chump change. And an especially large sum considering this is exclusive of the down payment, which is something you and your lender will be able to work out. In this case, it was only 1%. Far lower than the near-5% in fees alone.

One more time, every situation is unique, but please use this a general guide. Don’t just ask questions when going through this process, demand answers. After all, this is your hard earned money and you should be privy to where every penny goes.

xx

Cory

Now THIS is information we can all use!!!

Good posting Cory, under the subhead of Full Disclosure!

LikeLike